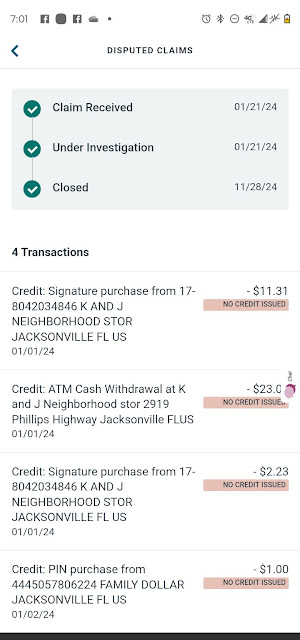

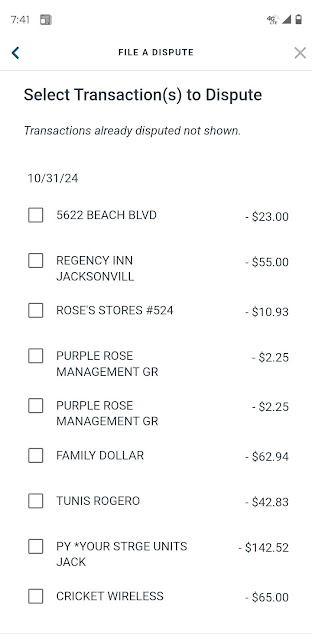

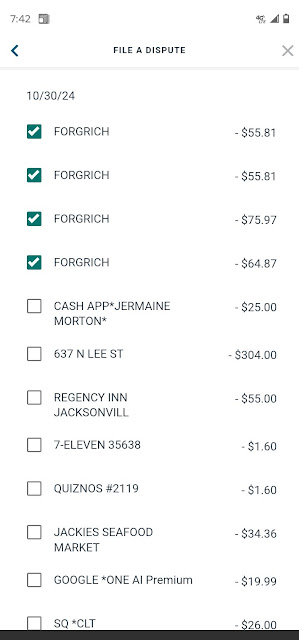

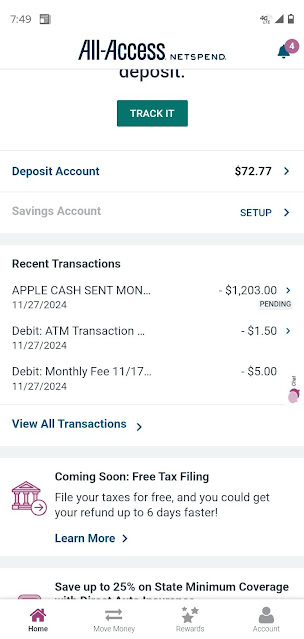

Bank negligence occurs when a financial institution breaches the duty of care that they owe a customer resulting in financial loss. When a bank provides a substandard service, it can be held liable for damages in some cases. defendant Netspends all access online Bank allegedly committed negligence identity verification process, The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Identity verification is the important process of ensuring that a person is who they claim to be when withdrawing from a bank account, A process is a series of progressive and interdependent steps by which an end is attained: the defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Allegedly Aiding and abetting is a legal doctrine that refers to the act of assisting or encouraging someone to commit a crime To be convicted of aiding and abetting, the accused must meet the following elements: Have the intent to help the crime be committed Have the intent of the underlying offense Have assisted in the commission of the offense Someone must have committed the offense Have the intent to help the crime be committed: Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Bank fraud aid; Electronic Funds Transfers Act (EFTA)Transferring money without JERMAINE MORTON permission The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Bank fraud backing; By Refusing to return money that was within process of unlawfully taken from Jermaine Morton NETSPEND all Access online bank account funds The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Bank fraud benefit; resulting in Jermaine Morton NETSPEND all Access online bank account financial loss The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Bank fraud compensation; defendant netspend acted deliberately Electronic Funds Transfers Act (EFTA)Transferring money without JERMAINE MORTON permission; The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Intentional negligence; aware that their actions will likely cause a certain result financial loss The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Bank fraud cooperation; netspends intentionally ignores their legal responsibilities and is aware of the potential consequences. It's also known as willful or wanton negligence. Where negligently managed online account security services or system errors result in customers sustaining financial loss The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Bank fraud help: NETSPEND given or provided what is necessary to accomplish a task or satisfy a need at the particular crime of bank fraud, The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence NETSPEND contribute strength or means to Electronic Funds Transfers Act (EFTA)Transferring money without JERMAINE MORTON permission; The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence netspend render assistance to Electronic Funds Transfers Act (EFTA)Transferring money without JERMAINE MORTON permission; The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence netspend cooperate effectively with bank fraud Electronic Funds Transfers Act (EFTA)Transferring money without JERMAINE MORTON permission; The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence aid; bank fraud Electronic Funds Transfers Act (EFTA)Transferring money without JERMAINE MORTON permission; assist; bank fraud Electronic Funds Transfers Act (EFTA)Transferring money without JERMAINE MORTON permission; The defendant Netspend allegedly aiding and abiding Bank fraud relief; relief” is used as a noun. Define as granting a particular remedy; as an Electronic Funds Transfers Act The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence Bank fraud service; Electronic Funds Transfers Act(EFTA) Bank fraud support; to agree with and give encouragement to someone or something because you want him, her, or it to succeed: The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol intentional negligence deliberately fails to meet the standard of care expected in their field, causing financial amount loss The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol intentional negligence The process of confirming or denying that a claimed identity is correct by comparing the credentials. The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol intentional negligence duty of care, The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol intentional negligence breach of duty of care, The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence causation, damages; unauthorized electronic funds transfer amount of 1,203$00¢ In relations Basic stages of money laundering 1):Placement (moving the funds from direct association with the crime) 2):Layering (disguising the trail to foil pursuit) Integration 3): (making the money available to the criminal from what seem to be legitimate sources Association with the crime) Criminal association means any combination of persons or enterprises engaging, or having the purpose of engaging, on a continuing basis in conduct which violates any one or more provisions of any felony statute of this state or which is the willful and illegal transportation JERMAINE MORTON active NetSpend card account holder Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol negligence of not requesting access with those credentials previously proven and stored in the PIV Card or system and associated with the identity being claimed. The defendant Netspend allegedly aiding and abiding identity theft utilization act of Bank fraud professional Bank protocol intentional negligence Knowledge-based authentication (KBA) Negligence without Asking a customer to answer preset security questions. These questions and answers are usually chosen and provided by the customer initially. The defendant Netspend allegedly aiding and abiding identity theft utilization act of bank fraud Netspend's professional protocol intentional negligence NetSpend did not utilize it's Two-factor authentication Requiring both something the user knows and something they have or are. This can include sending a one-time password (OTP) to the user's mobile app, email, or text. The defendant Netspend allegedly aiding and abiding identity theft utilization act of bank fraud Netspend's professional protocol intentional negligence Did not offer the user before tasking electronic money transfer Online identity verification The defendant Netspend allegedly aiding and abiding identity theft utilization act of bank fraud Netspend's professional protocol intentional negligence Using digital methods to confirm a person's identity remotely. This can include providing personal information and biometric data, and comparing it to stored reference data Association with the crime (making the money available to the criminal The defendant Netspend allegedly aiding means providing support or assistance to someone and abiding abetting means encouraging someone else to commit a crime supporting identity theft utilization bank funds within the act of bank fraud, money laundering, Association with the crime (making the money available to the criminal Netspend's professional protocol intentional negligence ### Allegations of Aiding and Abetting Identity Theft for Money Laundering The rise of digital banking has coincided with increased identity theft and money laundering. Two types of entities implicated in these crimes are financial institutions and technology companies, both of which allegedly facilitate these illegal activities through inadequate security measures. Financial Institutions: The Vulnerable Custodians Financial institutions, particularly banks, are expected to combat fraud through strict Know Your Customer (KYC) policies. However, some banks are accused of lax verification processes that allow fraudsters to open accounts using stolen identities. Once these accounts are established, criminals can deposit illicit funds and quickly transfer them elsewhere, creating a façade of legitimacy. This prioritization of profit over security can undermine the integrity of the banking system, enabling identity theft and money laundering. Technology Companies: The Enablers of Fraud Technology companies that provide online payment systems also play a significant role in facilitating identity theft. Many of these platforms allow users to create accounts with minimal verification, making them attractive targets for criminals. The rapid advancement of technology often outpaces regulatory measures, leading to inadequate monitoring of transactions. For example, a user might send large sums of money internationally without sufficient identity checks, obscuring the origins of the funds and facilitating money laundering. Conclusion The allegations against financial institutions and technology companies highlight the need for stronger security protocols and compliance measures. By enhancing customer verification processes and prioritizing regulatory adherence, these entities can help protect the integrity of the financial system and deter criminal activities. Only through collective accountability can we safeguard consumers against identity theft and fraud.

|

| Please donate 50¢ if you can to my cash app |

Accountability is an assurance that an individual or organization is evaluated on its performance or behavior related to something for which it is responsible. The term is related to responsibility but is regarded more from the perspective of oversight.

the quality or state of being accountable. especially an obligation or willingness to accept responsibility or to account for one's actions

Accountability refers to the processes, norms, and structures263 that hold the population and public officials legally responsible for their actions and that impose sanctions if they violate the law.

Accountability mechanisms include criminal prosecutions, civil lawsuits, and non-judicial systems such as truth commissions, ombudsmen, national human rights commissions, and intergovernmental body actions.

Comments

Post a Comment